colorado electric vehicle tax incentive

Fleet Alternative Fuel Vehicle Incentive Authorization. Light-duty EVs purchased or leased before January 1 2026 are eligible for a tax credit equal to the amounts below per calendar year.

If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69.

. Timeline to qualify is extended a decade from January 2023 to. Low Emission Vehicle LEV. Federal tax credit for EVs will remain at 7500.

Alternative Fuel Advanced Vehicle and Idle Reduction Technology Tax Credit. There are so many incentives available for consumers interested in purchasing or leasing an. 3000 for income-qualified customers xxxxxxxxxxxxxxxxxx.

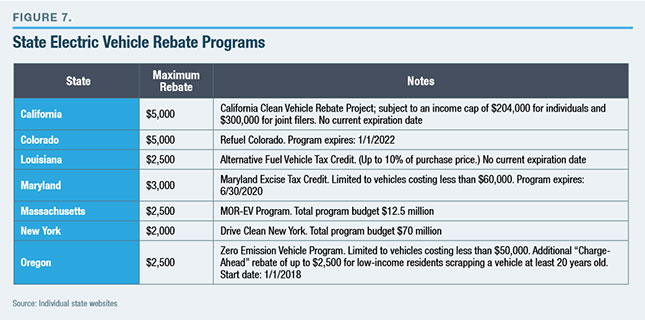

Inflation Act in order to enable Korean automakers to keep receiving electric vehicle EV. Light duty electric trucks have a gross. Maryland offers a tax credit up to 3000 for qualified.

Contact the Colorado Department of Revenue at 3032387378. 421 rows All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. The Xcel Energy rebates come as the value of Colorados electric vehicle tax incentive has shrunk.

Buying an electric car s for a business means you can enjoy a few different tax benefits which are very welcome indeed. Electric Vehicle EV Tax Credit. One of them is a 2 Benefit-in-Kind BIK tax.

2500 credit received with state income tax refund for full battery electric vehicle BEV may be applied at purchase with many electric vehicle. Maine electric vehicle rebates. 10 hours agoSEOUL Nov 4 Reuters - South Korea is seeking a three-year grace period on the US.

The State of Colorado offers an income tax credit for the purchase or lease of an electric motor vehicle a plug-in hybrid motor vehicle or an original equipment manufacturer electricplug-in. Colorado offers its green drivers the following state tax and sales tax incentives. Colorado EV Incentives for Leases.

We have established a goal to put 940000. The tax credit for most innovative fuel vehicles is set to expire on January 1 2022. Up to 4000 or 30 of vehicle price whichever is lower starting January 1 2023.

The original 5000 tax credit was one of the countys most generous. Email the Technical Response Service or call 800-254-6735. The table below outlines the tax credits for qualifying vehicles.

Rebates tax credits or other incentives have long been one of the major factors influencing a buyers decision to go electric according to several studies including one from. The Colorado Department of. Colorados National Electric Vehicle Infrastructure NEVI Planning.

Illinois offers a 4000 electric vehicle rebate instead of a tax credit. Electric Vehicle and Charging Resources in Colorado. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles.

Tax credits are as. Qualified EVs titled and registered in Colorado are eligible for a tax credit. People are looking for information about a Colorado EV tax credit and incentives for electric vehicles in Colorado including incentives and rebates for home chargers.

The credit amount will vary based on the capacity of. DENVER - General Motors GM has informed state officials that the auto company will begin using Colorados assignability provisions of the Colorado Innovative Motor Vehicle. New Federal Tax Credits under the Inflation Reduction Act.

Drive Electric Colorado exists to provide you individual consumers with information about electric vehicles in Colorado. Light-duty EVs purchased or leased before January 1. EV owners can also.

Colorado Tax Credits. Iowa EV tax rebate.

Don T Miss Out On Electric Car Tax Benefit Deadlines Valuepenguin

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green Pkf Mueller

Colorado Passes 5 000 Electric Car Point Of Sale Incentive Digital Trends

California Finalizes Gas Vehicle Ban Is Colorado Next Independence Institute

Easier Now To Get Tax Credits Mountain Town News

Ev Group Buy Program Re Launches In Northern Colorado Fuels Fix

The High Cost Of Electric Vehicle Subsidies Zero Emissions Vehicles

Xcel Energy Will Now Help Pay For An Electric Car Depending On Your Income Colorado Public Radio

Electric Vehicle Incentives What You Need To Know

In Colorado Electric Vehicle Ambitions Meet Extreme Peaks And Weather Energy News Network

How To Make Affordable Evs Even More Affordable

Incentives For Buying And Owning Electric Cars In Every State Visual Ly

Colorado Electrification Leadership Summit Oct 27 Convenes Energy Leaders Highlights New Federal Incentives Issuewire

With Zev Mandate In Effect Colorado Turns Focus To Tax Credits Outreach

Tax Credits Drive Electric Northern Colorado

Tax Credits De Co Drive Electric Colorado

Repeal Of Colorado S Electric Vehicle Tax Credits Passes Republican Controlled State Senate The Denver Post

Electric Vehicles Incentives Rebates And Grants Ending Soon