excise tax ma calculator

How often do you pay excise tax in MA. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

Home Seller Closing Costs In Massachusetts Closing Costs How To Plan Good Faith Estimate

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

. For any consideration over 10000 please use the Excise Calculator below to determine the required excise tax. - NO COMMA For. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Your exact excise tax can only be calculated at a Tag Office. It is an assessment in lieu of a personal property tax. You can use our Massachusetts Sales Tax Calculator to look up sales tax rates in Massachusetts by address zip code.

Ad Avalara excise tax solutions take the headache out of rate determination and compliance. Consideration between 100 and 10000 is not subject to excise tax. Massachusetts Sales Tax Calculator.

You also are not paying an amount which is assessed. We would like to show you a description here but the site wont allow us. Excise tax bills are prepared by the Registry of.

A tax rate of 1334 per proof. Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. Massachusetts imposes a corporate excise tax on certain businesses.

Excise tax bills are due annually for every vehicle owned and registered in Massachusetts. The calculator will show you. The minimum excise tax bill is 500.

As of January 1 2020 the current federal alcohol excise tax rates are. This is only an estimate. Your household income location filing status and number of personal.

Ad Looking for excise tax massachusetts. Content updated daily for excise tax massachusetts. Avalara solutions can help you determine excise tax and sales tax with greater accuracy.

Value for Excise x Rate 25 or 0025 Excise Amount. A tax rate of 270 per proof gallon on the first 100000 proof gallons in production. This method is only as exact as the purchase price of the vehicle.

Excise tax bills are prepared by the Registry of. Municipal Office Building 66 Central Square Bridgewater MA 02324 Phone. Massachusetts corporate excise tax is calculated by adding two different measures of tax depending on whether the corporation is a tangible or an intangible property.

The excise tax rate is 2500 per one thousand of assessed value. Consideration of Deed Total Excise Amount. Avalara solutions can help you determine excise tax and sales tax with greater accuracy.

The formula used to calculate this is the Manufacturers List Price x Ch60A percentage Value for Excise. Ad Download Or Email M-990T More Fillable Forms Register and Subscribe Now. Enter your vehicle cost.

The excise tax is 228 per 500. Excise tax bills are due annually for every vehicle owned and registered in Massachusetts. For the benefit of persons applying for motor vehicle abatements the Assessors require.

Corporate excise can apply to both domestic and foreign corporations. You did not pay a sales tax on it you paid an excise tax and the tax rate is not the same as the general sales tax rate. Town of Bridgewater MA.

How often do you pay excise tax in MA.

Araya Lakew Arayalakew Twitter

World Trade Organisation Learn Facts Medical Knowledge Ias Study Material

Benefits Word Cut Out Stock Images Pictures Alamy

A Guide To State Sales Tax Holidays In 2022

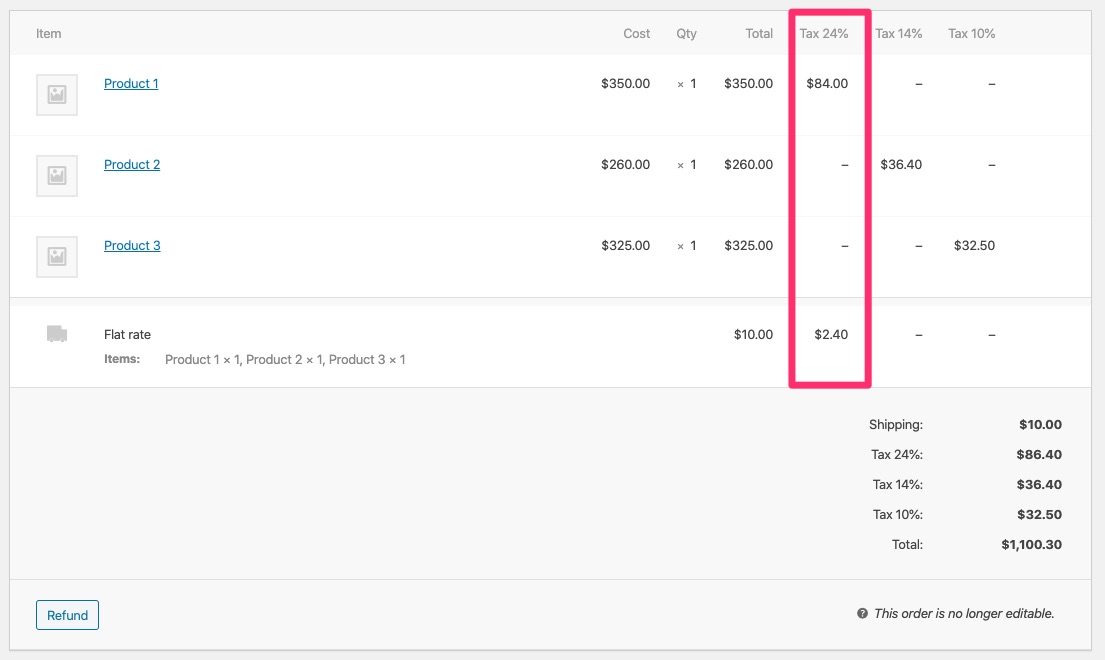

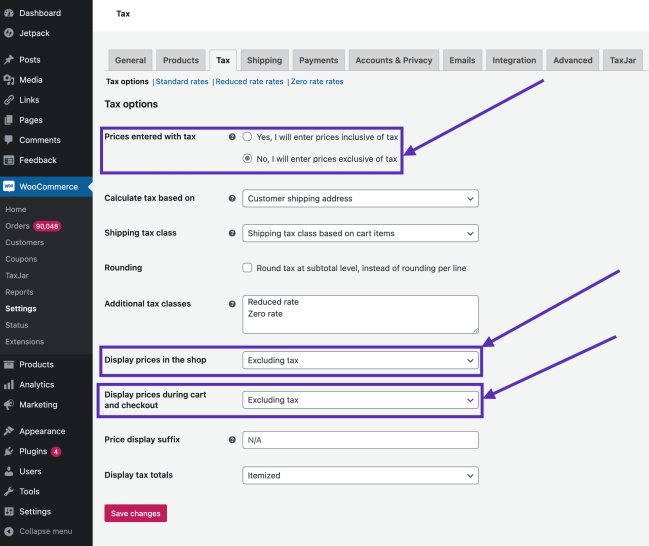

Setting Up Taxes In Woocommerce Woocommerce

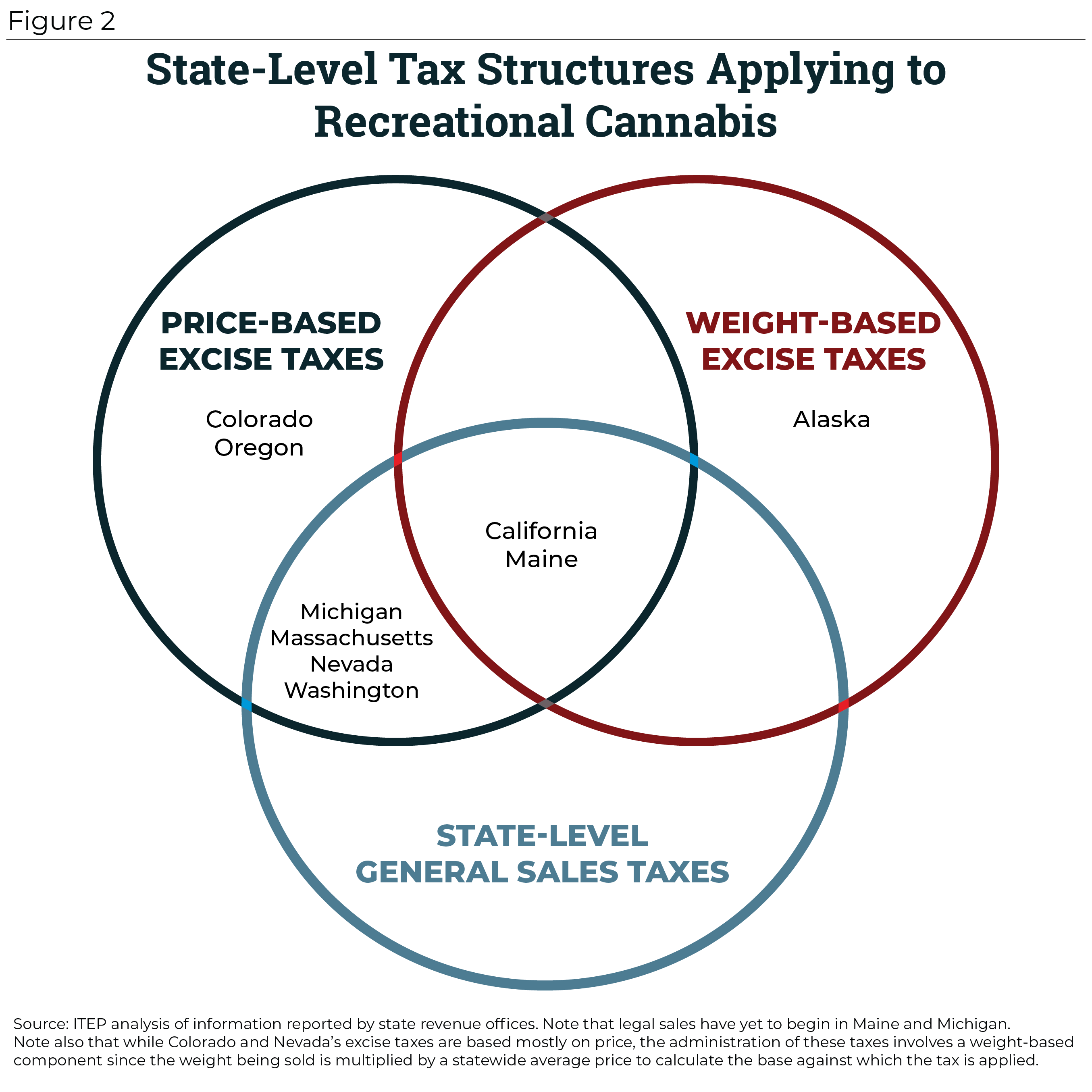

How To Calculate Cannabis Taxes At Your Dispensary

Car Tax By State Usa Manual Car Sales Tax Calculator

Australian Federal Budget 2022 Australian Expat Summary Oreana Financial

.png)

Weekend Briefing Edition 18 2022 Don T Buy The Dips Yet Eureka Report

Setting Up Taxes In Woocommerce Woocommerce

How To Calculate Cannabis Taxes At Your Dispensary

Dp Economics Unit 2 6 Price Elasticity Of Supply

Car Tax By State Usa Manual Car Sales Tax Calculator

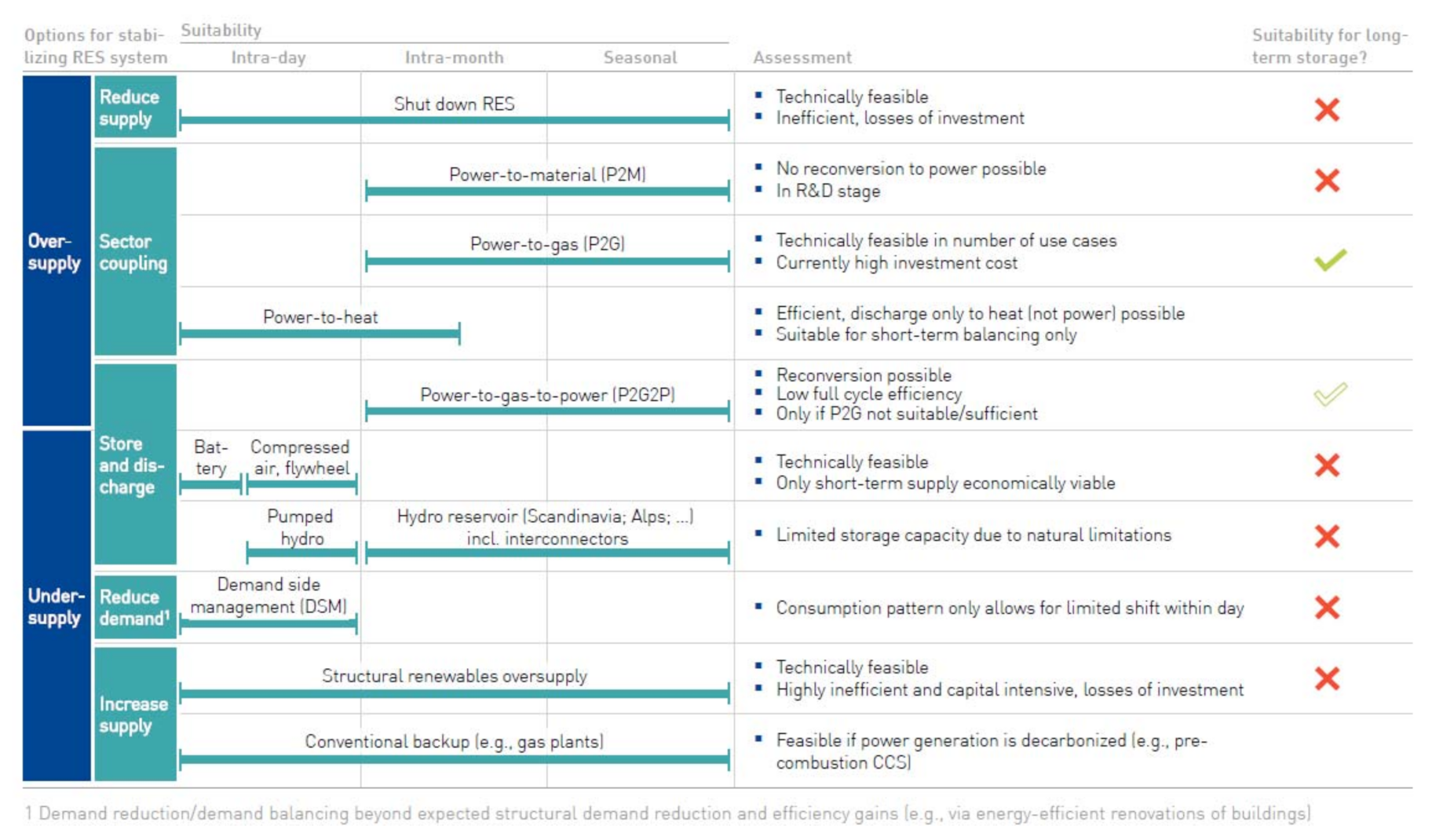

Energies Free Full Text Hydrogen In Grid Balancing The European Market Potential For Pressurized Alkaline Electrolyzers Html

Setting Up Taxes In Woocommerce Woocommerce

Car Tax By State Usa Manual Car Sales Tax Calculator