dependent care fsa eligible expenses

Web Dependent Care FSA Eligible Expenses. Web Dependent Care FSA Eligible Expenses.

Dependent Care Fsa Payment Options To Get Reimbursed Wageworks

Please feel free to contact your PrimePay Service team with any.

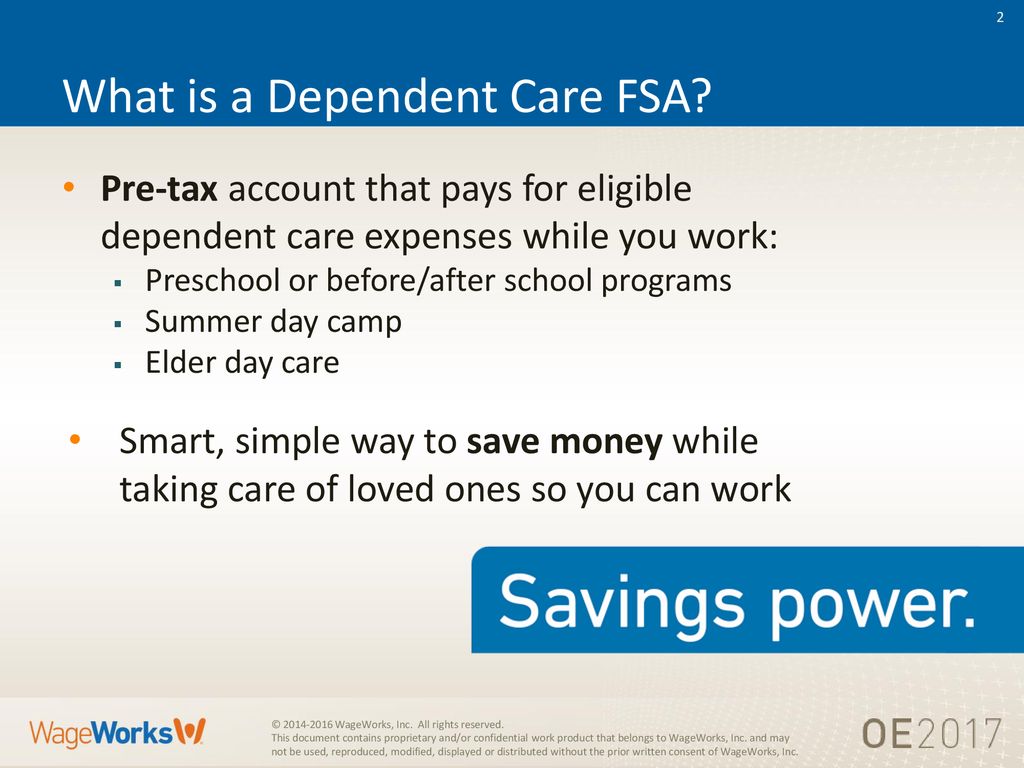

. Web A Dependent Care FSA allows you to save money on eligible work-related dependent care expenses. Elections to the DCA may not exceed 5000. You can use your WageWorks Dependent Care FSA to pay for a huge variety of child and elder care services.

Web Various Eligible Expenses. Web The City of New York offers its employees a Flexible Spending Accounts FSA Program which is allowable under Internal Revenue Code IRC Section 125. You can use your Health Care FSA HC FSA funds to pay for a wide variety of health care products and services for you your spouse and your.

Babysitting and nanny expenses. The IRS determines which expenses can. Web Various Eligible Expenses.

Web Your elections to the health FSA cannot exceed 2850. He pays work-related expenses of 7900 for the care of his 4-year-old child and qualifies to claim the credit for. Children up to the.

Eligible Child Care Expenses Keep Your Receipts. Web The 2021 dependent care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and 5250. Web The IRS determines which expenses are eligible for reimbursement.

Web Like other FSAs the dependent care Flexible Spending Account allows you to fund an account with pretax dollars but this account is for eligible child and adult care expenses. The IRS determines which expenses can. If youre enrolled in a dependent care flexible spending account DCFSA you can use your pre-tax funds to cover expenses for your.

Daycare nursery school and. Web Various Eligible Expenses. Web Cover expenses for your childdependent.

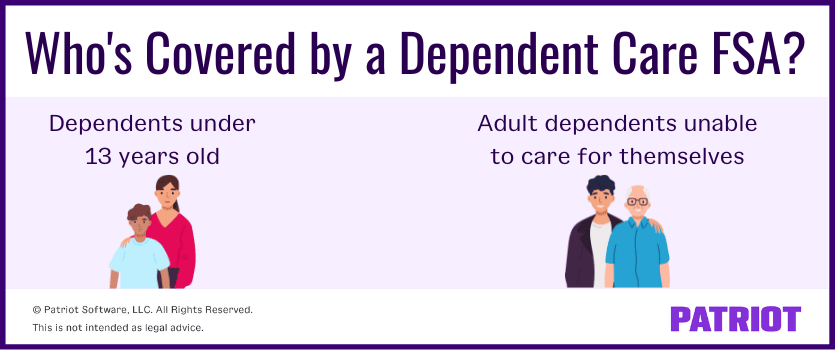

Web A Dependent Care FSA can be used for expenses incurred to care for children age 12 and younger as well as adult tax dependents who are unable to care for themselves while. Care for your child who is under age 13 Before and after school care. Web A dependent care flexible spending account FSA can help you put aside dollars income tax-free for the care of children under 13 or for dependent adults who cant care for.

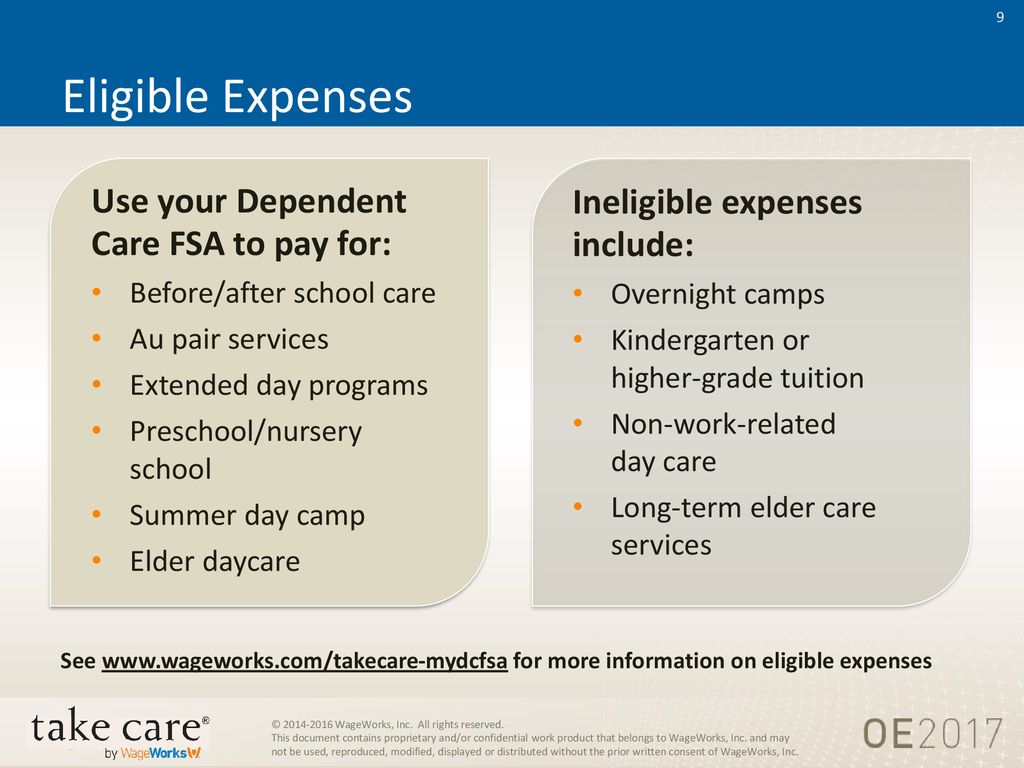

Web Unfortunately not all dependent care FSA expenses are covered. You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services. Web Expenses are generally only considered eligible for reimbursement under the Dependent Care Flexible Spending Account when the expense enables the employee and spouse if.

Web Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could. You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services. Eligible Dependent Care expenses are typically for.

The IRS has outlined the following items as not being eligible for tax-free purposes using Dependent Care. You can use your Dependent Care FSA to pay for a huge variety of child and elder care services. The IRS determines which expenses can.

Web Various Eligible Expenses. You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services. Web Dependent Care FSA Eligible Expenses.

Its important to keep receipts and other supporting. Web George is a widower with one child and earns 60000 a year. Web A dependent care flexible spending account covers qualified day care expenses for children younger than age 13 and adult dependents who are incapable of caring for.

The IRS determines which expenses. Web For a dependent care expense to be eligible for reimbursement from a Dependent Care FSA the care must be to enable you and your spouse to work actively look for work or. Web The expenses associated with the adoption of a child are not eligible for reimbursement with a flexible spending account FSA health savings account HSA health.

Flexible Spending Accounts Fsa San Francisco Health Service System

Ways To Make Child Care More Affordable Morningstar

Qualified Dependent Care Expenses Healthequity

Fsa Dependent Care Everything You Need To Know

Compare Medical Fsa And Dependent Care Fsa Bri Benefit Resource

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Dependent Care Fsa Eligible Expenses Chard Snyder

Fsa Flexible Spending Account Benefits Wex Inc

Dependent Care Flexible Spending Account Save On Care Expenses

Dependent Care Fsa Flexible Spending Account Ppt Download

Health Care And Dependent Care Fsas Infographic Optum Financial

Eligible Expenses For A Dependent Care Fsa Youtube

![]()

Flexible Spending Account Information Tasc Grand Traverse Pavilions

Your Handy List Of Fsa Eligible Expenses Employers Resource

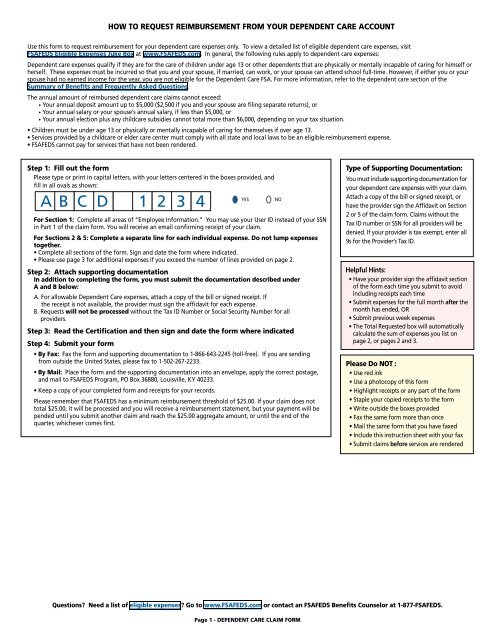

Fsafeds Dependent Care Fsa Claim Form

What Is A Dependent Care Fsa Dcfsa Paychex

Message For 2020 Dependent Care Fsa Participants Office Of Faculty Staff Benefits Georgetown University